Paid a $4,000 cash to purchase land. Paid cash dividends amount to $ Paid $2,200 of cash expenses. Net income would then be… o Revenue – Expenses ($3,000 – $2,200) Net income is $ Kilgore Company experience the following events during it’s first accounting period. Issued common stock for $5,000 cash; Earned $3,000 of cash revenue

Lady Danger: 1 (The Warrior Maids of Rivenloch) : Campbell, Glynnis: Amazon.in: Books

Sep 4, 2023Final answer: An asset source transaction refers to the event of a company acquiring cash from an external source to increase its assets. In this case, the purchase of land by Simpson Company is an asset source transaction. Explanation: The event of Simpson Company paying cash to purchase land is an asset source transaction.

Source Image: fstoppers.com

Download Image

Sep 3, 2023question No one rated this answer yet — why not be the first? 😎 raajratan Final answer: The correct answer is Option B. The event of Simpson Company paying cash to purchase land is an asset use transaction. Explanation:

Source Image: coursehero.com

Download Image

From college to the barbershop, here are the 10 best Simpsons episodes of all time, ranked – The Manual Simpson Company had the following balances in its accounting records as of December 31, Year 1: Help Assets Cash Accounts Receivable Land Total $ 40,000 9,000 51,080 $100,000 Liabilities and Equity Accounts Payable Common Stock Retained Earnings Total $ 7,500 45,000 47,500 $100,000 The following accounting events apply to Simpson Company’s Year

Source Image: chegg.com

Download Image

Simpson Company Paid Cash To Purchase Land. This Event Is

Simpson Company had the following balances in its accounting records as of December 31, Year 1: Help Assets Cash Accounts Receivable Land Total $ 40,000 9,000 51,080 $100,000 Liabilities and Equity Accounts Payable Common Stock Retained Earnings Total $ 7,500 45,000 47,500 $100,000 The following accounting events apply to Simpson Company’s Year Question: Knowledge Check 01 Simpson Company purchased $900 of equipment by paying cash and recorded the expenditure as a purchase of land. The error was discovered a week later. Prepare the two journal entries required to correct the error.

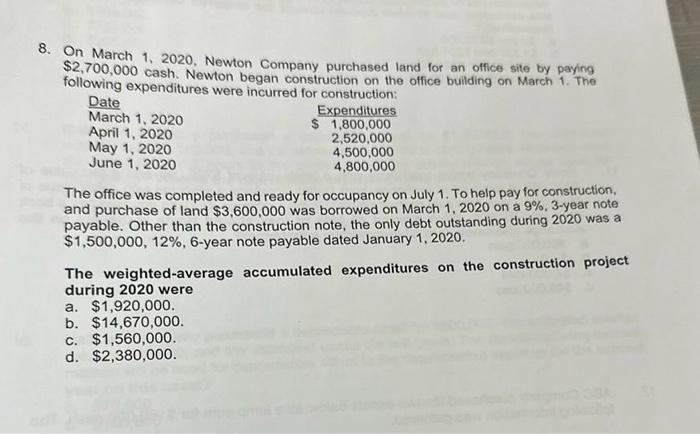

Solved On March 1, 2020, Newton Company purchased land for | Chegg.com

Study with Quizlet and memorize flashcards containing terms like Sims Company received cash from the issue of common stock. This event is A. an asset source transaction. B. an asset use transaction. C. an asset exchange transaction. D. None of the answers describes this event., Sims Company received cash from the issue of a note payable to a bank. This event is A. an asset source transaction Cometh Battle Launches Mission 9 with Amazing Rewards for Members of its Community | PlayToEarn

Source Image: playtoearn.net

Download Image

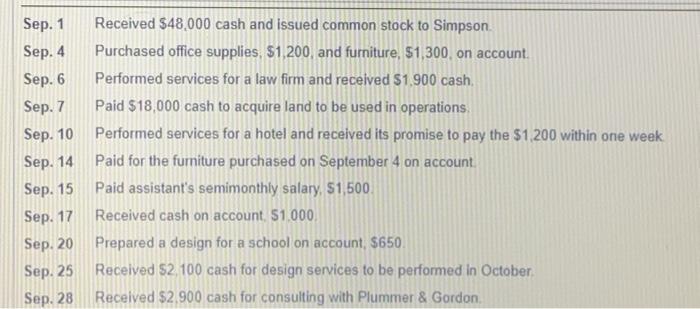

Solved Sep. 1 Sep.4 Sep. 6 Sep. 7 Sep. 10 Sep. 14 Sep. 15 | Chegg.com Study with Quizlet and memorize flashcards containing terms like Sims Company received cash from the issue of common stock. This event is A. an asset source transaction. B. an asset use transaction. C. an asset exchange transaction. D. None of the answers describes this event., Sims Company received cash from the issue of a note payable to a bank. This event is A. an asset source transaction

Source Image: chegg.com

Download Image

Lady Danger: 1 (The Warrior Maids of Rivenloch) : Campbell, Glynnis: Amazon.in: Books Paid a $4,000 cash to purchase land. Paid cash dividends amount to $ Paid $2,200 of cash expenses. Net income would then be… o Revenue – Expenses ($3,000 – $2,200) Net income is $ Kilgore Company experience the following events during it’s first accounting period. Issued common stock for $5,000 cash; Earned $3,000 of cash revenue

Source Image: amazon.in

Download Image

From college to the barbershop, here are the 10 best Simpsons episodes of all time, ranked – The Manual Sep 3, 2023question No one rated this answer yet — why not be the first? 😎 raajratan Final answer: The correct answer is Option B. The event of Simpson Company paying cash to purchase land is an asset use transaction. Explanation:

Source Image: themanual.com

Download Image

Essays Of Africa May 2016 by Kwenta Media – Issuu Answer and Explanation: 1 Become a Study.com member to unlock this answer! Create your account View this answer The correct option is (c). Option a) No, the given transaction is not an asset source

Source Image: issuu.com

Download Image

Computer & Video Games – Issue 132 (1992-11)(EMAP Publishing)(GB) : Free Download, Borrow, and Streaming : Internet Archive Simpson Company had the following balances in its accounting records as of December 31, Year 1: Help Assets Cash Accounts Receivable Land Total $ 40,000 9,000 51,080 $100,000 Liabilities and Equity Accounts Payable Common Stock Retained Earnings Total $ 7,500 45,000 47,500 $100,000 The following accounting events apply to Simpson Company’s Year

Source Image: archive.org

Download Image

Captive Heart: 2 (The Warrior Maids of Rivenloch) : Campbell, Glynnis: Amazon.in: Books Question: Knowledge Check 01 Simpson Company purchased $900 of equipment by paying cash and recorded the expenditure as a purchase of land. The error was discovered a week later. Prepare the two journal entries required to correct the error.

Source Image: amazon.in

Download Image

Solved Sep. 1 Sep.4 Sep. 6 Sep. 7 Sep. 10 Sep. 14 Sep. 15 | Chegg.com

Captive Heart: 2 (The Warrior Maids of Rivenloch) : Campbell, Glynnis: Amazon.in: Books Sep 4, 2023Final answer: An asset source transaction refers to the event of a company acquiring cash from an external source to increase its assets. In this case, the purchase of land by Simpson Company is an asset source transaction. Explanation: The event of Simpson Company paying cash to purchase land is an asset source transaction.

From college to the barbershop, here are the 10 best Simpsons episodes of all time, ranked – The Manual Computer & Video Games – Issue 132 (1992-11)(EMAP Publishing)(GB) : Free Download, Borrow, and Streaming : Internet Archive Answer and Explanation: 1 Become a Study.com member to unlock this answer! Create your account View this answer The correct option is (c). Option a) No, the given transaction is not an asset source