Jan 16, 2024Inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. Central banks attempt to limit inflation

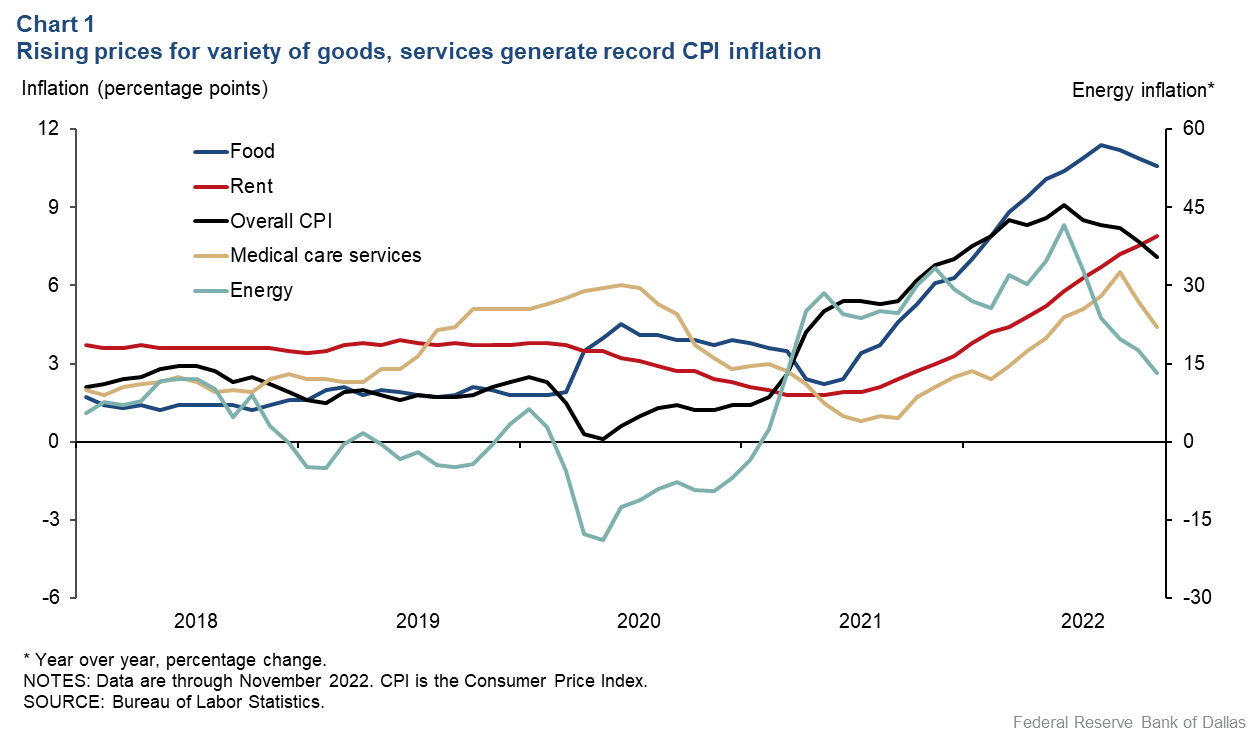

High inflation disproportionately hurts low-income households – Dallasfed.org

Inflation erodes the value of money and financial assets. The value of money depends on what it will buy. As prices go up, the purchasing power of money declines. The value of your bank balance also decreases since with higher prices, it takes more money to purchase the same quantity of goods and services.

Source Image: cekindo.com

Download Image

Nov 15, 2023Inflation is caused by our government injecting more currency into the economy. To put this all in perspective, the U.S. dollar has lost 87% of its purchasing power since abandoning the gold

Source Image: todayonline.com

Download Image

Musings on Markets: Risk free rates and value: Dealing with historically low risk free rates

First, when inflation rates are very high, the longer you hold money as cash, the more value it loses, so you attempt to spend it immediately rather than hold it. In this situation, money does not function as an effective store of value. In fact, if people expect high rates of inflation and the rate of their transactions increases as a result

Source Image: libertystreeteconomics.newyorkfed.org

Download Image

When An Economy Experiences Inflation The Value Of Money

First, when inflation rates are very high, the longer you hold money as cash, the more value it loses, so you attempt to spend it immediately rather than hold it. In this situation, money does not function as an effective store of value. In fact, if people expect high rates of inflation and the rate of their transactions increases as a result

Inflation reduces the value of money. Because of that, people who have borrowed money benefit from a higher inflation rate when they pay the money back. The interest rate that a borrower pays is effectively lower thanks to inflation.

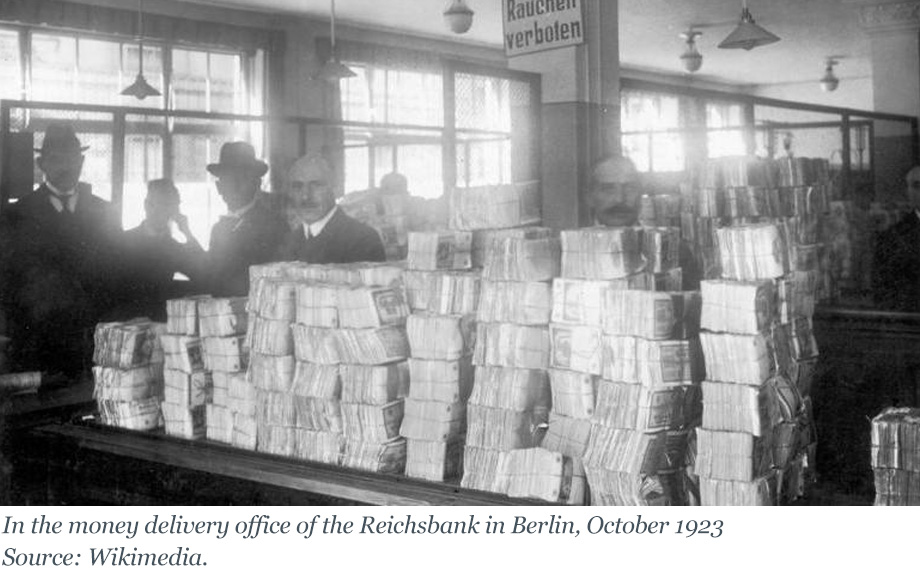

Inflating Away the Debt: The Debt-Inflation Channel of German Hyperinflation – Liberty Street Economics

Question When an economy experiences inflation, the value of money increases initially decreases but then increases. initially increases but then decreases. does not change. decreases Solution Verified Answered 10 months ago Create an account to view solutions By signing up, you accept Quizlet’s Terms of Service and Privacy Policy

Zero Inflation’ A Flawed Ideal – Foundation for Economic Education

Source Image: fee.org

Download Image

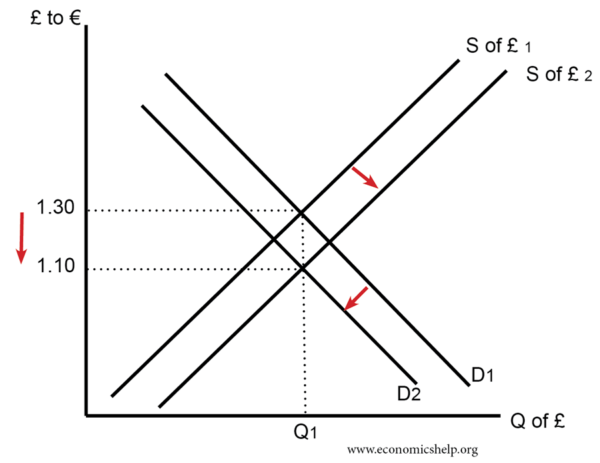

Inflation and Exchange Rates – Economics Help

Question When an economy experiences inflation, the value of money increases initially decreases but then increases. initially increases but then decreases. does not change. decreases Solution Verified Answered 10 months ago Create an account to view solutions By signing up, you accept Quizlet’s Terms of Service and Privacy Policy

Source Image: economicshelp.org

Download Image

High inflation disproportionately hurts low-income households – Dallasfed.org

Jan 16, 2024Inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. Central banks attempt to limit inflation

Source Image: dallasfed.org

Download Image

Musings on Markets: Risk free rates and value: Dealing with historically low risk free rates

Nov 15, 2023Inflation is caused by our government injecting more currency into the economy. To put this all in perspective, the U.S. dollar has lost 87% of its purchasing power since abandoning the gold

Source Image: aswathdamodaran.blogspot.com

Download Image

How to prepare yourself for hyperinflation: tips from the Venezuelan experience | Learn Liberty

An annual inflation rate of 2%, 3%, or 4%, however, is a long way from a national crisis. Low inflation is also better than deflation which occurs with severe recessions. Second, an argument is sometimes made that moderate inflation may help the economy by making wages in labor markets more flexible.

Source Image: learnliberty.org

Download Image

Causes of inflation & how it affects trading? – Skilling

First, when inflation rates are very high, the longer you hold money as cash, the more value it loses, so you attempt to spend it immediately rather than hold it. In this situation, money does not function as an effective store of value. In fact, if people expect high rates of inflation and the rate of their transactions increases as a result

Source Image: skilling.com

Download Image

When an economy experiences inflation, the value of money: | Quizlet

Inflation reduces the value of money. Because of that, people who have borrowed money benefit from a higher inflation rate when they pay the money back. The interest rate that a borrower pays is effectively lower thanks to inflation.

Source Image: quizlet.com

Download Image

Inflation and Exchange Rates – Economics Help

When an economy experiences inflation, the value of money: | Quizlet

Inflation erodes the value of money and financial assets. The value of money depends on what it will buy. As prices go up, the purchasing power of money declines. The value of your bank balance also decreases since with higher prices, it takes more money to purchase the same quantity of goods and services.

Musings on Markets: Risk free rates and value: Dealing with historically low risk free rates Causes of inflation & how it affects trading? – Skilling

An annual inflation rate of 2%, 3%, or 4%, however, is a long way from a national crisis. Low inflation is also better than deflation which occurs with severe recessions. Second, an argument is sometimes made that moderate inflation may help the economy by making wages in labor markets more flexible.